Copy and paste the code to share this infographic on your site

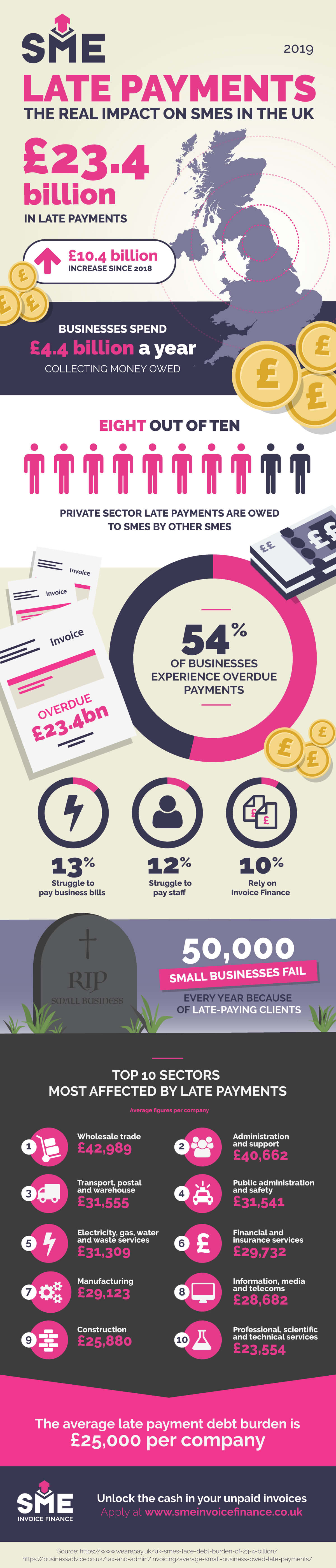

One of the most significant issues for small businesses and SME’s across the UK is late-paying customers. Whether you are a home-based freelancer, a small business or SME, they all share the same common issue – getting invoices paid on time. In 2019 there was a staggering £23.4 billion outstanding in late payments – that’s up £10.4 billion from 2018, according to a study released by Pay.UK

Not just frustrating for the small business owner as it costs businesses in time and money to chase outstanding debt. In fact, businesses spend around £4.4billion a year in collecting money owed.

There’s no getting away from the facts with reports suggesting that 54% of all businesses experience overdue payments. 13% of which those businesses who are affected struggle to pay their bills, 12% struggle to pay staff and 10% rely on invoice financing to help with their cash-flow. The late-payment debt burden averages out at around £25,000 per company across the UK.

Paul Horlock, CEO of Pay.UK, said: “It is concerning that so many smaller businesses are struggling because of late payments in 2019, especially as there are so many ways they can now get paid. Offering customers a choice of payment or automated options can help remove barriers to make sure a bill is settled on time.”

Late paying customers is an unfortunate reality of running a business. If you are not set-up to cope with late payments, then your business could perish under the cash-flow pressure. The facts point to around 50,000 firms a year who fail because of late-paying clients.

Wholesale Trade, Administration and Support Services are high on the list for businesses affected by late payments each suffering the burden of around £40,000 while construction companies are at the lower end of the scale bearing an average of in £25,000 late-payments. Eight out of Ten Private Sector late payments are owed to SME’s by other SME’s.

It’s a challenge that your business doesn’t need to work through alone. With a range of Invoice Finance products available for almost any type of business who raises invoices to other businesses, we can help you find the best solution for you. Whether it’s a single invoice or multiple invoices that you would like to unlock and receive funds early, at SME Invoice Finance, we can help.